Q. Who is eligible for the USAble Life MA PFML?

A. Employers with 25 or more employees are eligible for USAble Life’s MA PFML Compliant Plan and require custom underwriting quoting.

Q. Will USAble Life allow an employer to cover medical only or family only with their private option?

A. No, USAble Life will only offer plans that cover both medical and family benefits. USAble Life believes that the claim experience will suffer if one part of MA PFML is covered through a private option and the other through the state plan.

For example, someone is on medical leave due to pregnancy bed rest and then transitions to family leave after the birth of a child. Due to the combined maximum of 26 weeks and the strong potential that employees may have both medical and family leaves in a benefit year, it is not advantageous for an employer to cover medical and family leave through two different organizations.

Q. What options do employers have if we want to provide benefits that are more generous than the statutory minimum benefits?

A. Several options are available with USAble Life that provide better than statutory benefits:

Q. How will MA PFML interact with USAble Life’s Short Term Disability benefits?

A. USAble Life will offset the amount of the MA PFML benefit against the Short Term Disability benefit in circumstances where the employee is eligible for both MA PFML and Short Term Disability.

We will reduce the Short Term Disability rates accordingly based on the MA PFML offset when the Short Term Disability is offered along with MA PFML.

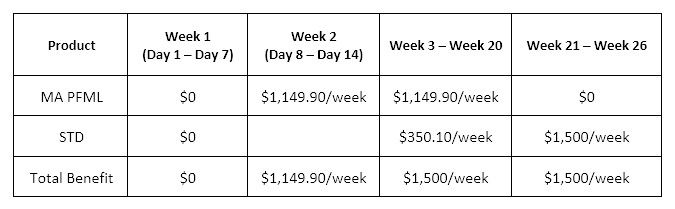

Example:

A high-earning employee has a medical situation and is temporarily disabled for 26 weeks in accordance with the contract provisions of both MA PFML and Short Term Disability.

Assumptions:

1. They have a salary that warrants a total $1,500 weekly from their Short Term Disability benefit, and they reach the maximum of $1,149.90 weekly from MA PFML benefit

2. Short Term Disability elimination period (EP) is 14 days

3. Short Term Disability plan has a 26-week duration

Q. Will we have to complete a new employer application with USAble Life?

A. Yes, since the MA PFML is a different product and certificate, a new employer application will be required.

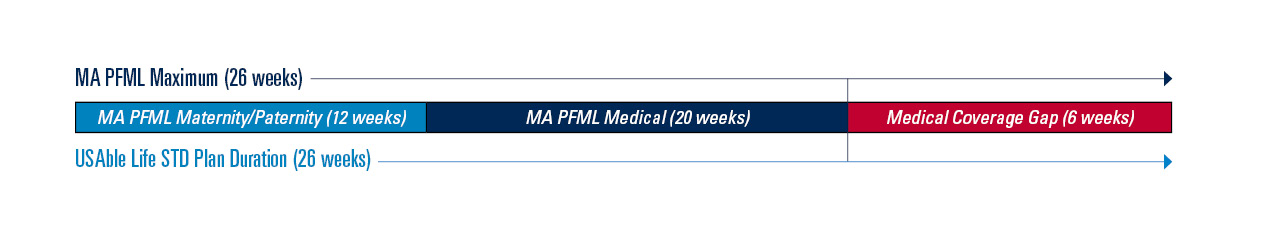

Q. If offering Short Term Disability benefits in addition to MA PMFL, what is USAble Life’s guidance on duration?

A. When covering employees under both the MA PFML and Short Term Disability, USAble Life recommends offering the Short Term Disability plan with a 26-week duration to match the MA PFML 26-week duration maximum.

Q. How does a claim work if someone is on bed rest (medical) and then gives birth (family)?

A. This is likely a common scenario where a MA PFML medical leave will convert to family leave. As long as the required claim information is submitted and the initial elimination period has been met, the benefit payment will be continuous through the medical and family claim up to the 26-week maximum duration allowed in a benefit year.

Q. What happens if a claimant is also covered under another state’s statutory PFML program?

A. Other state or federal statutory benefits are coordinated and are subject to offsets under the MA PMFL contract.

Q. Can former employees obtain MA PFML benefits?

A. Yes, an employee continues to be eligible for MA PFML benefits if the employee has been separated from employment for not more than 26 weeks at the start of the leave.